Irs Tax Extension Form For S Corporation. The form, which is available for free (click here) from the irs website, requires only a few bits of information: If you need more time to prepare your federal tax return, consider filing for an s corporation extension.

Is there a filing deadline extension? The efile process includes 24/7 live support and immediate irs approval.

Federal Tax Deadline 2025 Extension Inga Regina, “this can be a common mistake,”. From there, you can electronically request an extension that automatically extends your filing date until oct.

Federal Tax Deadline 2025 Extension Inga Regina, Once this form is completed and. The annual s corporation filing deadline for irs form 1120s is the 15th day of the third month following the end of the corporation’s tax year.

Need more time to file a federal tax return? It’s easy with IRS Free File, Also known as the u.s. You can extend filing form 1120s when you file form 7004.

Free Tax Extension 2025 Online Raye Valene, If you need more time to prepare your federal tax return, consider filing for an s corporation extension. If october 15 falls on a saturday, sunday, or legal holiday,.

2025 Tax Extension Nissy Andriana, “this can be a common mistake,”. The annual s corporation filing deadline for irs form 1120s is the 15th day of the third month following the end of the corporation’s tax year.

Filing Estimated Taxes 2025 Lily Shelbi, File form 4868, application for automatic extension of time to file u.s. For returns required to be filed in calendar years beginning before jan.

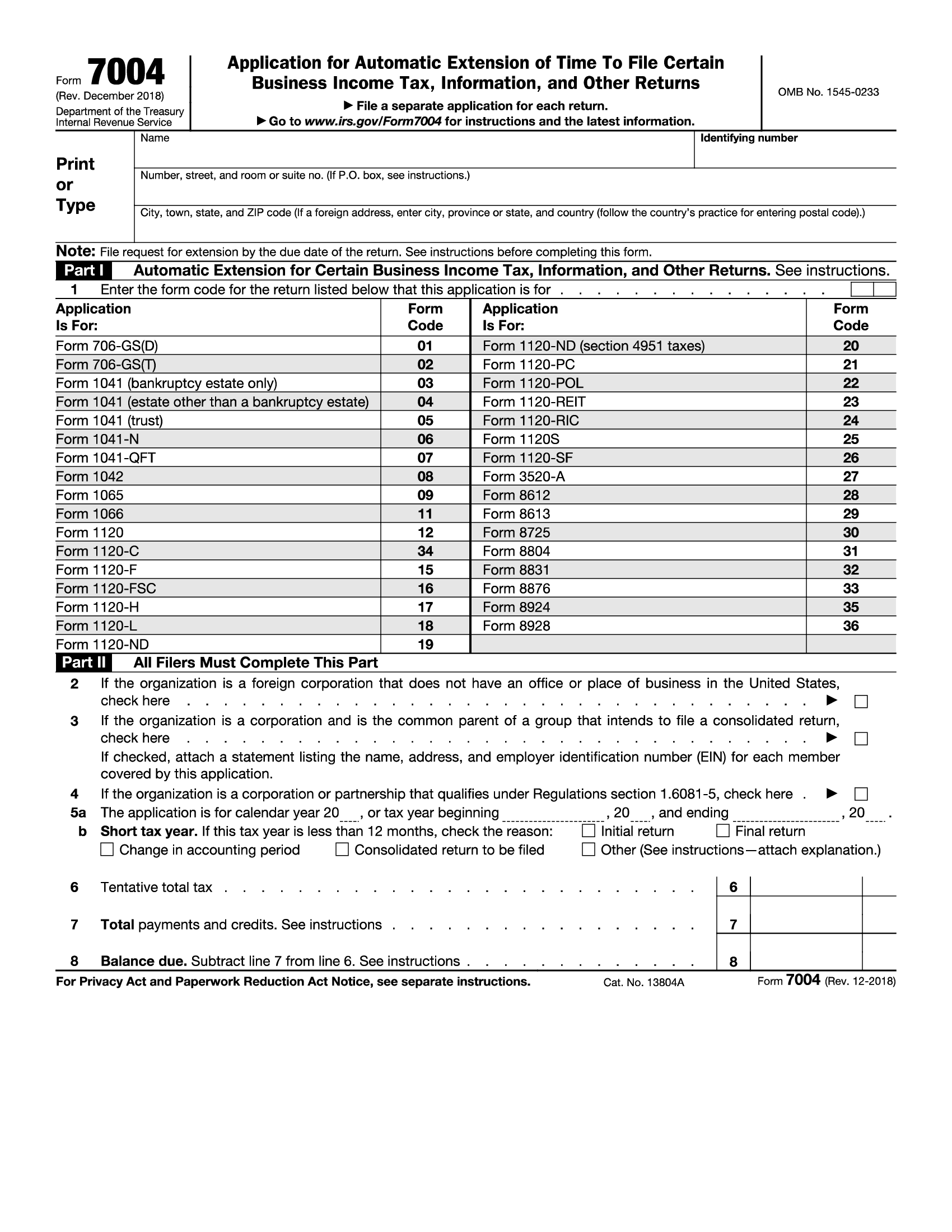

IRS Form 7004. Application for Automatic Extension of Time To File, Is there a filing deadline extension? From there, you can electronically request an extension that automatically extends your filing date until oct.

Last Day File Taxes 2025 Agna Merrill, For s corps whose financial year runs with the calendar year, the. By filing irs form 7004 on or before the tax return’s due date, generally by the 15th of the third month following the end of its.

Printable Tax Extension Form, Enter code 25 in the box on form 7004, line 1. Also known as the u.s.

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png)

Partnership Filing Deadline 2025 Clara Demetra, Although s corporations generally won’t have to pay income taxes, they are still required to file a tax return. Form 2553, election by a small business corporation.

If your s corporation extension has been rejected because the company did not file form 2553 to elect s corporation status, it is.