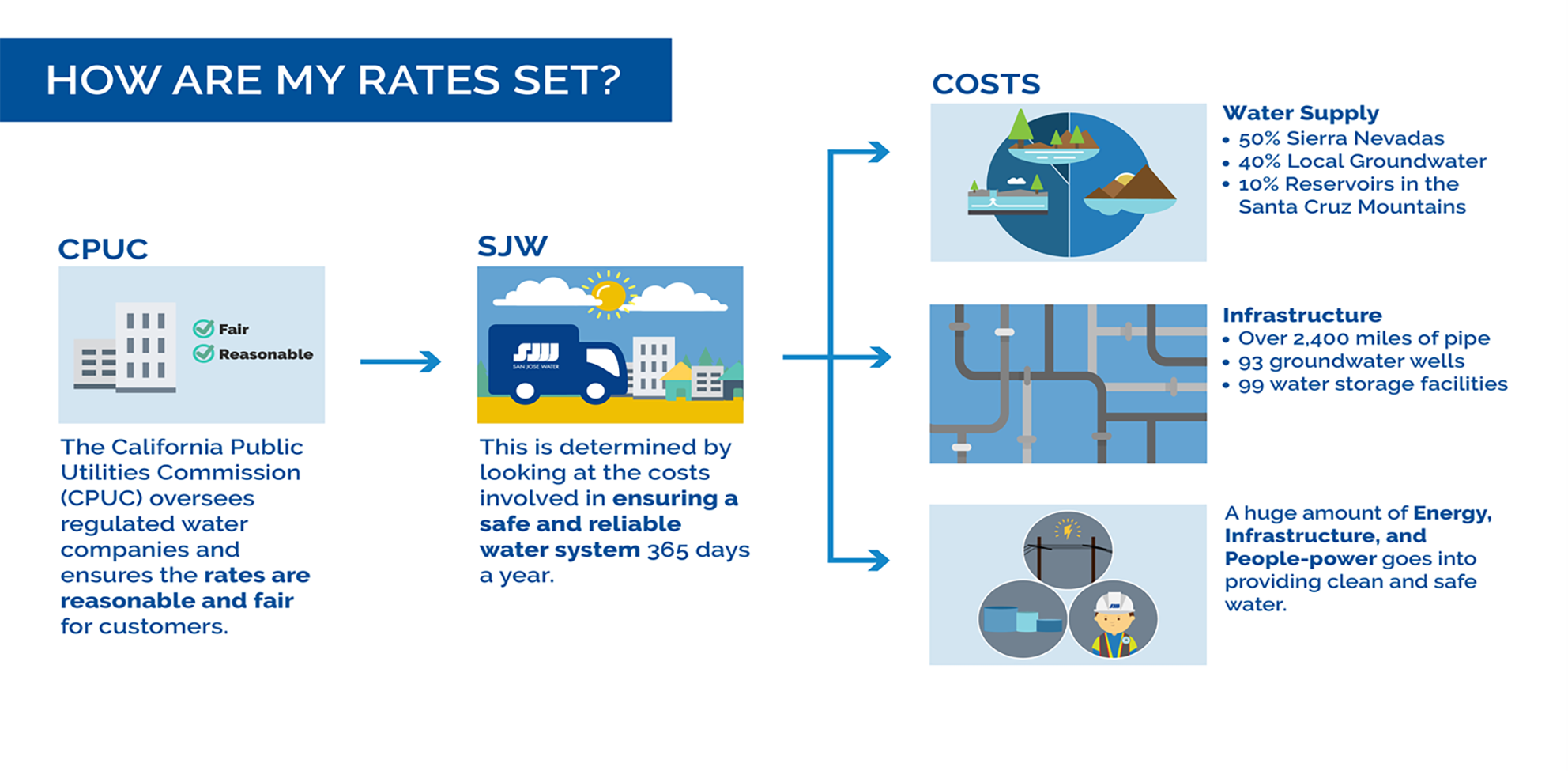

California Mileage Reimbursement Rate 2025. 67 cents per mile driven for business use, up 1.5 cents from 2025. Mileage reimbursement rates in the uk.

67 cents per mile driven for business use, up 1.5 cents from 2025. Transportation (airfare rates, pov rates, etc.) privately owned vehicle (pov) mileage reimbursement rates.

California Mileage Rate 2025 Calculator Goldy Karissa, “unless you live in california, massachusetts, or illinois, your budget for travel dollars does not necessarily have to increase this year,” she advises. While minimum wages are increasing, the irs gave employees who drive for company business another present this holiday season:

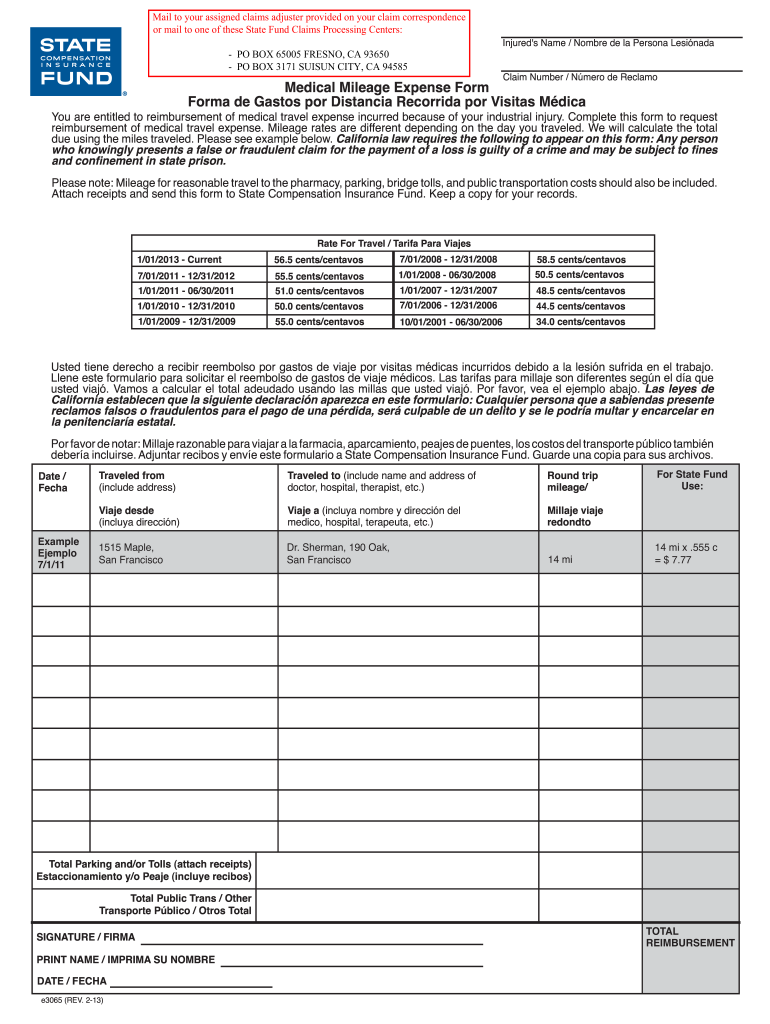

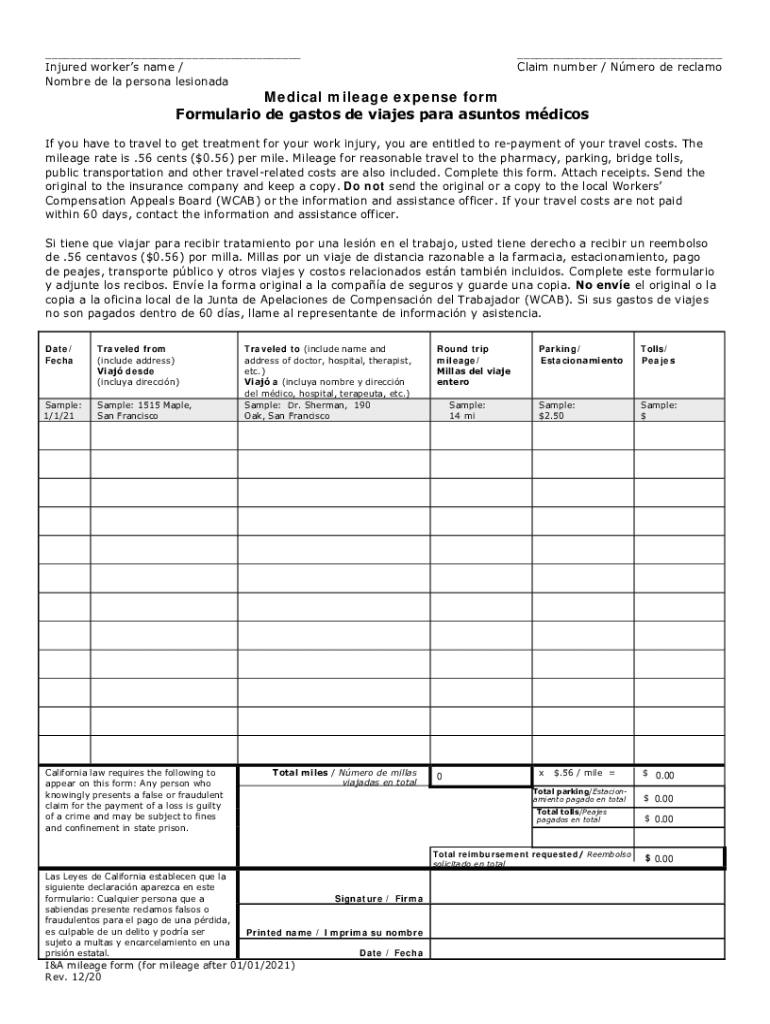

Free Mileage Log Templates Smartsheet (2025), The irs has set the 2025 standard mileage rate for. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’.

California Mileage Reimbursement Requirements Explained (2025), Do california companies have to use the irs. For medical purposes and moving for active military members, this amount is 22 cents per mile, and for charity purposes, it is 14 cents per.

I a mileage form 2025 Fill out & sign online DocHub, So if one of your employees drives for 10 miles, you would reimburse them $6.70. Miles driven in 2025 for business purposes.

Mileage California 2025 Joan Maryanne, 2025 mileage reimbursement rate calculator. Gsa has adjusted all pov mileage reimbursement.

.png)

California mileage verification form Fill out & sign online DocHub, California mileage rates for 2025. The irs also announced its current mileage rate, which is 67 cents per mile for business purposes in the year 2025.

Minimum Wage For California 2025 Terza Michal, Miles driven in 2025 for medical. California mileage reimbursement forecast 2025.

Mileage Reimbursement 2025 In California Faunie Kirbee, Since january 1st, 2025, the irs standard mileage rate has been.67 cents per mile. Beginning on january 1, 2025, the millage rate for reimbursement for business use will increase to 67 cents per mile.

2025 & 2025 Mileage Reimbursement Calculator Internal Revenue Code, The 2025 federal mileage reimbursement rates have arrived. If you need a medical mileage expense form for a year not listed here, please contact the information and assistance unit at your closest district office of the workers’.

Ca 2025 Mileage Rate Schedule Wynne Karlotte, “unless you live in california, massachusetts, or illinois, your budget for travel dollars does not necessarily have to increase this year,” she advises. Gsa has adjusted all pov mileage reimbursement.